Following a stream of queries to our Virtual Tax Partner support service, we have a new Employer's quick guide to Broadband and an update on partnership structures.

We have also been busy updating our Finance Act 2011 Planner, our Self-Employed Accounts Toolkit, and a range of other guides. Please scroll down to see an update summary.

You can now follow us on Twitter.

Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner: practical support for accountants, tax advisers and their clients

News and FREEVIEW

PAYE: Real Time Information (RTI)

Panic over for now: HMRC revises timetable for employer implementation.

VAT: compulsory online filing - April 2012

For the majority of registered businesses: no new news for those without broadband.

National minimum wage

NMW hits £6.08 from 1 October 2011.

Concern grows over HMRC's Record Checks

What does HMRC really mean when it uses the term "pilot"?

Late filing a SA return: automatic penalties

A penalty applies regardless of whether you have a liability or have made a payment.

Guides and updates

For PAID subscribers (because you are so special :)

Recent new guides and updates

Broadband (Employer's guide)

NEW: our at a glance guide summarises the different combinations and their tax treatment.

Enterprise Investment Scheme (EIS)

UPDATE: Brussels approves Budget 2011 announcements.

Finance Act 2011: tax planner

UPDATE: our rolling CPD tool is designed to keep you on top of key legislative changes and announcements.

Tax penalties: grounds for appeal

UPDATE: cases added for reasonable excuse and reliance on accountants. Note VAT and direct tax differences.

Accounts: tax health check (self-employed)

UPDATE: new links and section on Gifts and Donations.

Mobile phones & employees

UPDATE: when is a phone not a phone i-wonder?

Fixed sum allowances: set classes of employee

NEW: it is worth reviewing the list from time to time.

Can I back-claim capital allowances on residential property?

UPDATE: a rewrite of this guide with improved links.

Recent updates

Running an LLP in tandem with a company

UPDATE: in tandem or corporate partners? Lots of plusses and minuses for professional practices.

Employment status checklist

UPDATE: following the Autoclenz decision clients may wish to review their working relationships with self-employed subcontractors.

Employment status: directors

UPDATE: the difference in treatment of office holders under tax and employment law.

Employment status: partners

NEW: this guide considers considers some of the key issues facing professional firms.

Furnished Holiday Letting

UPDATE: and major rewrite to include 2011 FA provisions including examples on Averaging and Period of grace reliefs.

Business Property Relief: holding companies

UPDATE: following recent queries we have included further examples to deal with mixed trading groups.

Joint property elections

UPDATE: new links, following new guidance from HMRC.

Goodwill: trade related properties

UPDATE: new tabs, clearer guidance on valuation with new links.

Interest: paid on loans from directors

NEW: mini-guide. Is interest paid gross or net? At what rate? Tax relief when irrecoverable.

Capital Gains Tax: Entrepreneurs' Relief

UPDATE: new sections including planning points and pitfalls for private company shares

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.

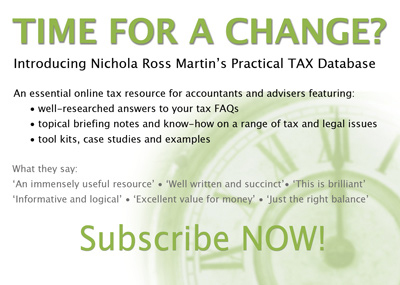

Subscribe now

Come and join us .