A closer look at a tax case where the accountant's negligence in failing to follow GAAP proved expensive for an unincorporated contractor.

PAYE: the Low Income Tax Reform Group have created a new Guide to PAYE Underpayments...More

See below for updates for subscribers and don't miss the rolling news summary for July 2011.

Bye for now,

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner: practical support for accountants, tax advisers and their clients

News headlines

Revenue recognition (UITF 40): tax case report

An accountant's failure to prepare unincorporated accounts according to GAAP led to a penalty for an unlucky contractor client.

New guide to PAYE underpayments

The Low Income Tax Reform Group's new guide is something to add to your "favourites".

Adviser Tax Update

READ ME! Rolling update for July 2011

Was the Tax Rewrite Project worth it?

While the public are still baffled by tax law, what do the professionals think?

Guides and updates

For PAID subscribers (because you are so special :)

Recent new guides and updates

Capital gains reliefs: disposal of business assets

UPDATE: hold-over reliefs: a new and improved section.

Valuation (of goodwill) on incorporation

UPDATE: new examples for small businesses.

Goodwill and the intangibles regime

UPDATE: new section, case law and links

Goodwill: trade related properties

UPDATE: new tabs, clearer guidance on valuation with new links.

Our notes and guides now list recent updates/rewrites in the "Small print and links" tabs.

Previous week's updates

Furnished Holiday Letting

UPDATE: ensure clients are ready for the changes.

IHT transferable nil rate band

Make sure you keep records for the second death

Long-life assets

The rules for capital allowances.

Capital allowances

2011/12 updated: take a tour of the section.

ABC shares: family companies

A guide that examines the tax consequences of creating new share classes.

Incorporation

A section of the site with guides on valuation of goodwill, tax avoidance issues, and worked examples to help you choose the right CGT relief.

Adviser's Tax Penalty Planner

A summary of the late filing penalties for CIS, SA and CT.

PAYE & Settlement Agreements - (how to gross up for)

Do you pay an employee's personal bill, or do you provide the benefit and pay the tax on that instead?

Accounts health check (self-employed)

UPDATED: a general re-write with more interactive links.

These guides consider the different methods available for extracting funds from a company.

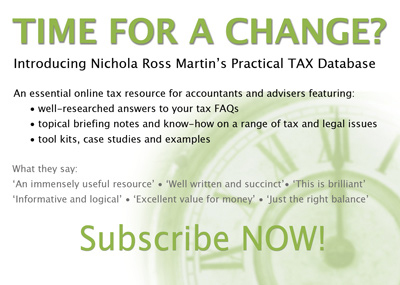

Subscribe now

Come and join us .