Two essential updates for subscribers, freeview guides and news, please scroll down for links.

Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner: practical support for accountants, tax advisers and their clients

News and FREEVIEW

PAYE pooling: new consultation

Or legal nightmare...More

Protesters demand Dave Hartnett's resignation

Protesters move on Whitehall...More

Gains-Cooper loses residency appeal

Supreme court ignores day counting...More

Time to Pay: revealed HMRC double standards

Size matters...More

Bona Vacantia: concession dropped

Striking off requires a Capital Reduction...More

Guides and updates

FREEVIEW mini-guides

Starting in business: start here

NEW: menu and tax summaries

Joint property elections

UPDATE: HMRC change Form 17

Ceasing trading: overview

UPDATE: a summary of the mechanics for companies with a look at the tax on final distributions

Retirement: a purchase of own shares

NEW: menu and summary

For PAID subscribers (because you are special :)

Essential reading this time:

Joint property: legal v beneficial ownership

UPDATE: a rewrite, this guide explains the differences, looks at transfer of beneficial ownership, issues for spouses and Declarations of Trust

Repairs and renewals

UPDATE: new "At a glance" section & case law: highly recommended

Recent updates

Capital reduction: distributing capital reserves

UPDATE: why and how to guide for advisers

Bona Vacantia & striking off

UPDATE: a summary of the key issues for advisers to watch out for and advise clients

Solvency statement: reduction of capital (winding up)

Template: as required for a reduction in capital

Capital reduction with a purchase of own shares

UPDATE: this is a very complicated combination, so we have created this checklist

Capital reduction: tax treatment

UPDATE: this guide examines the position where a capital reduction is used and trading is ongoing.

Broadband (Employer's guide)

NEW: our at a glance guide summarises the different combinations and their tax treatment.

Tax penalties: grounds for appeal

UPDATE: cases added for reasonable excuse and reliance on accountants. Note VAT and direct tax differences.

Finance Act 2011: tax planner

UPDATE: our rolling CPD tool is designed to keep you on top of key legislative changes and announcements.

Can I back-claim capital allowances on residential property?

UPDATE: a rewrite of this guide with improved links.

Recent updates

Running an LLP in tandem with a company

UPDATE: in tandem or corporate partners? Lots of plusses and minuses for professional practices.

Employment status checklist

UPDATE: following the Autoclenz decision clients may wish to review their working relationships with self-employed subcontractors.

Employment status: directors

UPDATE: the difference in treatment of office holders under tax and employment law.

Employment status: partners

NEW: this guide considers a problem for some professional firms.

Furnished Holiday Letting

UPDATE: a major rewrite to include 2011 FA provisions including examples on Averaging and Period of Grace reliefs.

Business Property Relief: holding companies

UPDATE: following recent queries we have included further examples to deal with mixed trading groups.

Joint property elections

UPDATE: new links, following new guidance from HMRC.

Goodwill: trade related properties

UPDATE: new tabs, clearer guidance on valuation with new links.

Interest: paid on loans from directors

NEW: mini-guide. Is interest paid gross or net? At what rate? Tax relief when irrecoverable.

Capital Gains Tax: Entrepreneurs' Relief

UPDATE: new sections including planning points and pitfalls for private company shares

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.

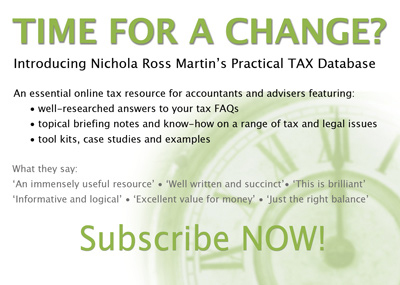

Subscribe now

Come and join us .

Copyright Ross Martin Tax Consultancy Limited © 2009 to-date.