Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

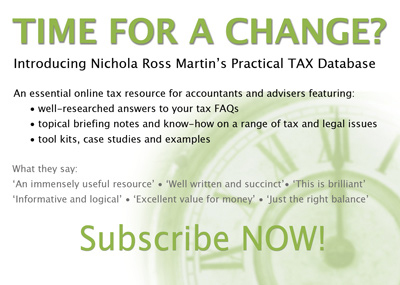

www.rossmartin.co.uk

Your online Virtual Tax Partner: practical support for accountants, tax advisers and their clients

Essential reading:

Finance Bill 2012

Key measures for the SME adviser broken down into manageable chunks.

Autumn Tax Update

Not the Finance Bill: a summary of interesting tax tips and news

Tax relief on Christmas Parties

That "old chestnut"

Guides and updates

Subscribers only:

Finance Bills and Acts: rolling CPD planner

UPDATED: key issues and what's new

Gifts to staff and trivial benefits and business gifts

UPDATED: to clarify tax relief on business gifts

Entertaining

UPDATED: you may obtain tax relief on some costs of entertaining as this guide explains

Subsistence

UPDATE: case law - where an estimate may be acceptable

Recently updated favourites

ABC or alphabet shares: family companies

UPDATE: consideration of the tax consequences of creating new share classes

Can I back-claim capital allowances on residential property?

UPDATE: a review of current tax breaks to discuss with clients

Running an LLP in tandem with a company

UPDATE: lots of pluses and minuses for professional practices.

PAYE late payment penalties buster

Top tips for employers: you need to change your behaviour - but not quite in the way that HMRC had planned

Updates from last time

Close Investment Holding Companies

UPDATE: two recent reports from the Tribunals indicate how easy it is to overlook the rules

Employment status checklist

UPDATE: three new cases add some dimension to the existing tests

Capital Gains Tax: Entrepreneurs' Relief

UPDATE: comparing the disposal of part of a business and its assets

Recent updates

Furnished Holiday Letting

UPDATE: a major rewrite to include 2011 FA provisions including examples on Averaging and Period of Grace reliefs

Fees and subscriptions (professional bodies)

UPDATED: no tax deduction against employment income if not on HMRC's list

Workplace nurseries

NEW: these continue to attract unlimited exemption from tax and NICs

PAYE: late payment penalties

UPDATE: further guidance for mitigation by clients, with examples

Bona Vacantia & striking off

Our summary of the key issues for advisers to watch out for and advise clients

Retirement: a purchase of own shares

A menu and summary

VAT: a whole new section

Toolkits, practical guides, current reclaim opportunities and updates

Joint property: legal v beneficial ownership

This guide explains the differences, looks at transfer of beneficial ownership, issues for spouses and Declarations of Trust

Capital reduction with a purchase of own shares

UPDATE: this is a very complicated combination, so we have created this checklist

Capital reduction: tax treatment

UPDATE: this guide examines the position where a capital reduction is used and trading is ongoing.

Broadband (Employer's guide)

NEW: our at a glance guide summarises the different combinations and their tax treatment.

Employment status: directors

UPDATE: the difference in treatment of office holders under tax and employment law.

Employment status: partners

NEW: this guide considers a problem for some professional firms.

Business Property Relief: holding companies

UPDATE: following recent queries we have included further examples to deal with mixed trading groups.

Interest: paid on loans from directors

NEW: mini-guide. Is interest paid gross or net? At what rate? Tax relief when irrecoverable.

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.