It looks as though HMRC has got a head start on the latter: we learn that having failed to realise how many Self-Assessment statements it was supposed to be sending out for 31 July, our biggest department ran out of paper.

Makes a change from "lost in the post", I suppose.

Please scroll down for News, Freeview and Updates for subscribers below.

Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner: practical support for accountants, tax advisers and their clients

News and FREEVIEW

31 July reminders: HMRC runs out of paper

500,000 taxpayers affected

Lunn & Co: HMRC withdraws agent status again

Firm fails to justify why it should be allowed to continue

Goodwill and franchises (take two)

Another tax case show that franchisees do create saleable goodwill.

Directors' loan accounts: toolkit

UPDATE: for 2011/12

Adviser Tax Update

Rolling update for July 2011

Guides and updates

For PAID subscribers (because you are so special :)

Recent new guides and updates

Interest: paid on loans from directors

NEW: mini-guide. Is interest paid gross or net? At what rate? Tax relief when irrecoverable.

Capital Gains Tax: Entrepreneurs' Relief

UPDATE: new sections including planning points and pitfalls for private company shares

Capital gains reliefs: disposal of business assets

UPDATE: new and improved section on hold-over reliefs.

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.

Goodwill and the intangibles regime

UPDATE: new section, case law and links

Goodwill: trade related properties

UPDATE: new tabs, clearer guidance on valuation with new links.

Our notes and guides now list recent updates/rewrites in the "Small print and links" tabs.

Favourites from previous week's updates

Furnished Holiday Letting

UPDATE: ensure clients are ready for the changes.

Capital allowances

2011/12 updated: take a tour of the section.

ABC shares: family companies

A guide that examines the tax consequences of creating new share classes.

Incorporation

UPDATE: a section of the site with guides on valuation of goodwill, tax avoidance issues, and worked examples.

Accounts health check (self-employed)

UPDATED: a general re-write with more interactive links.

These guides consider the different methods available for extracting funds from a company.

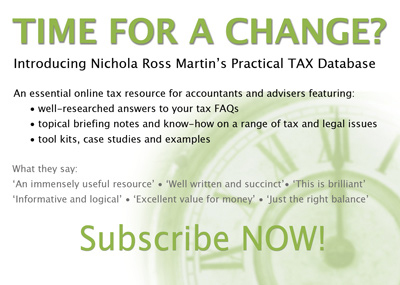

Subscribe now

Come and join us .