We are back after a bit of a break. What a summer it has been and "well done" Andy Murray and all our Olympians*.

This week's issue is something of an "at a glance" summary of news and essentials that you might have missed over the summer months.

Don't miss our updated Director's loan account toolkit and PAYE penalties buster.

Scroll on down to read more

* "Olympians" in this instance, refers to all atheletes from both sets of games.

Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner®: practical support for accountants, tax advisers and their clients

News:

New agent pilot postponed

The tax bodies have been successful in making HMRC halt a controversial new pilot which would have resulted in visits to accountants and advisers whose clients are seen as under performing by HMRC.

Campaign to keep ESC A19 intact

Sign the online petition to preserve this safeguard.

CIOT: don’t legislate for ‘controlling persons’

Calls that new legislation is unneccessary for the private sector when the problem of engaging executives via their personal service companies relates to the way that appointment are handled in the public sector.

Tax data

Advisory fuel rates (company car drivers)

New rates from 1 September 2012.

National minimum wage rates

Increase from 1 October 2012.

Compliance checks - appointing a temporary adviser

If a taxpayer requires the assistance of a specialist during the course of an investigation they can appoint an additional adviser using a new online authorisation form.

EIS or SEIS: advanced assurance from HMRC

A new form to check out your qualifying criteria. If you would assistance in applying contact our Virtual Tax Partner support line.

Latest disclosure opportunities

Direct Selling Campaign

HMRC's latest tax disclosure opportunity targets party planners, agents and distributors.

The Tax Return Initiative

Another disclosure opportunity which is designed to allow defaulting taxpayers to bring their tax affairs up to date. This initiative offers what appears to be the best deal yet - 0% penalties.

Home improvement sweep up

Another disclosure opportunity is being planned for later this Autumn, this one is aimed at the building and allied trades.

Essential reading

Directors' loan accounts: toolkit

HMRC's instruction to its staff is that they examine directors' private expenditure during the course of an enquiry into a close company's books and records. In most cases the company will be expected to produce a transaction history of any director's loan or current account.

Dispensations, agencies and umbrella companies

HMRC has issued a statement confirming its views on so called "Pay Day Relief Models" and Dispensations. It is aimed at the employers of temporary staff who are using these models to net expenses off against gross pay.

Negligence by an adviser

Two cases with contrasting results. No tax penalties can be assessed on a taxpayer when his tax return error is made due to an adviser giving the wrong advice. However, the extent that delegation is possible depends on the nature of the error and the individual circumstances of the situation.

Extra Statutory Concession A19

A19 allows HMRC to not collect certain liabilities in respect of income tax and capital gains tax. It is consulting on revising the wording.

Recent guides and updates

Finance Act 2012: index & summary

What's new and where to find it.

PAYE late payment penalties buster

UPDATE: this guide is essential reading if you are having cashflow problems or do not understand these penalties.

Tax masterclass: running an LLP & Co structure

Sample our Masterclass guide to business combinations. This one is ideal for trading companies and professional practices.

High Income Child Benefit Tax Charge (HICBC)

Practice note with examples and handy tables to work out who pays the charge.

Land and Property - Adviser Update

This is one of our periodic CPD updates for subscribers, have a quick browse and follow the links into detailed guidance.

Student Loans

HMRC guide on how to report under SA.

NICs on dividends

Key issues for those in tax schemes.

How do you tax ABC or alphabet shares?

For share awards outside family companies, see:

For a run down on the basic rules on taxing awards of shares and securities see:

If you are dealing with family companies and shares are being issued to family members, see:

Editor's choice:

Furnished Holiday Letting

Including examples on Averaging and Period of Grace reliefs.

Retirement: purchase of own shares

Menu and summary.

Capital reduction: tax treatment

This guide examines the position where a capital reduction is used to return excess share capital or capital reserves to shareholders and trading is ongoing. Not to be confused with a purchase of shares out of distributable reserves.

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.

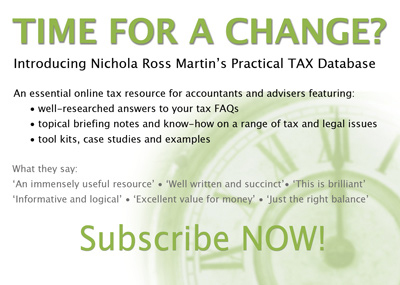

Subscribe now

Come and join us .