In this time's Web-update: tax avoidance continues to be a headline grabber despite the Olympics...

Last week David Gauke announced a crackdown on "Tax Cowboys", with plans to extend DOTAS. This week the ICAEW has issued a helpsheet so that members might consider not only the damage to the reputation of the profession, but also their liability to damages if a scheme fails to do what it says in the small print - that is assuming that anyone can genuinely understand the small print.

Never wishing to miss a band wagon, we have created Fifty Schemes of Grey: our guide to finding the acceptable middle ground in tax planning for SME owners.

On a more serious note, for subscribers we have new guides to the 2012 Finance Act, including the High Income Child Benefit charge, a tax Masterclass on tax planning with LLP combinations and much more. Scroll down for all the updates.

Best wishes

Nichola

Nichola Ross Martin FCA

Tax Director

www.rossmartin.co.uk

Your online Virtual Tax Partner®: practical support for accountants, tax advisers and their clients

News:

Fifty Schemes of Grey

What tax planning do we think is acceptable for SME owners?

Government targets ‘cowboy’ tax scheme promoters

New proposals to extend DOTAS and name and shame.

PWC tax avoidance scheme fails on appeal

Top of the ICAEW's hit list: an aggressive loss scheme is ruled a non-starter.

Football tax debts: a league of their own

Has HMRC gone soft on football clubs?

Compliance checks - appointing a temporary adviser

If a taxpayer requires the assistance of a specialist during the course of an investigation they can appoint an additional adviser using a new online authorisation form.

Essential reading:

ICAEW helpsheet: aggressive tax avoidance schemes

Guidance which will interest advisers as well as accountants.

Tax masterclass: running an LLP & Co structure

Introducing our new Masterclass guide to business combinations. This one is ideal for trading companies and professional practices.

High Income Child Benefit Tax Charge (HICBC)

NEW: practice note with examples and handy tables to work out who pays the charge.

Finance Act 2012: index & summary

What's new and where to find it.

Extra Statutory Concession A19

A19 allows HMRC to not collect certain liabilities in respect of income tax and capital gains tax. It is consulting on revising the wording.

What is the Ramsay principle in tax?

A mini-guide.

Lecturers, teachers or instructors

Lecturers, teachers or instructors are no longer included in the list of occupations for NIC purposes. The following occupations are earners for NICs:

• office cleaners

• ministers of religion

• people employed by their husband or wife or civil partner for the purpose of his or her employment

• theatrical performers/artists within the entertainment industry.

Tax cases summary

HMRC v Healy - test case on accommodation

HMRC has been given leave to appeal to the UTT following the decision by the First Tier Tribunal to allow tax relief on an actor's accommodation costs.

Coopers v HMRC [2012] UKFTT 439 (TC) TC 02120

A cautionary tale in partnership tax planning. A partnership was set up to provide cars to a company owned by the partners, who were also its directors in an arrangement aiming to avoid car benefit charge. The Tribunal found that the partnership was "little more than an extension of the company set up and operated in order to avoid or reduce income tax and a National Insurance charge for the company." In paying the partnership to provide cars which were used by the directors, the company was indirectly providing cars and fuel "by reason of employment" and so a tax charge resulted for the directors with Class 1A for the employer.

See Tax masterclass: running an LLP & Co structure for guidance on how to avoid a similar charge.

Aspect Capital Limited v HMRC [2012] UKFTT 430 (TC) TC02112

A nil paid employee share scheme failed. Employees were transferred shares under a scheme to avoid an income tax and NICs charge. The shares remained unpaid however the Tribunal agreed with HMRC that a debt arose on transfer and as the company was a close company there was a deemed charge under s419(1) ICTA 1988 (now s455 CTA 2010) on loans to participators.

Sloane Robinson Investment Services Limited v HMRC [2012] UKFTT 451 TC02132

Yet another failed tax scheme involving an employer putting money into companies which rewarded employees with shares and money came out again when the investee companies were liquidated. The Tribunal found that the money was bonuses and earnings from employment.

Recent guides and updates

Land and Property - Adviser Update

This is one of our periodic CPD updates for subscribers, have a quick browse and follow the links into detailed guidance.

Advisory fuel rates (company car drivers)

New rates from 1 June 2012.

EIS or SEIS: advanced assurance from HMRC

A new form to check out your qualifying criteria.

Student Loans

HMRC guide on how to report under SA.

Guides and updates

Subscribers only:

NICs on dividends

Key issues for those in tax schemes.

How do you tax ABC or alphabet shares?

For share awards outside family companies, see:

For a run down on the basic rules on taxing awards of shares and securities see:

If you are dealing with family companies and shares are being issued to family members, see:

Editor's choice:

Furnished Holiday Letting

Including examples on Averaging and Period of Grace reliefs.

Retirement: a purchase of own shares

A menu and summary.

Capital reduction: tax treatment

This guide examines the position where a capital reduction is used to return excess share capital or capital reserves to shareholders and trading is ongoing. Not to be confused with a purchase of shares out of distributable reserves.

Valuation (of goodwill) on incorporation

UPDATE: new examples for small & lifestyle businesses.

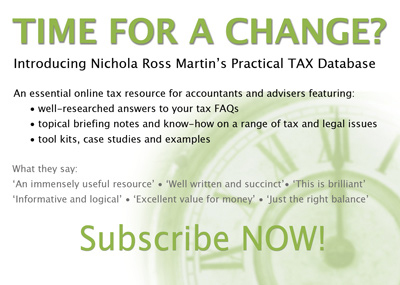

Subscribe now

Come and join us .