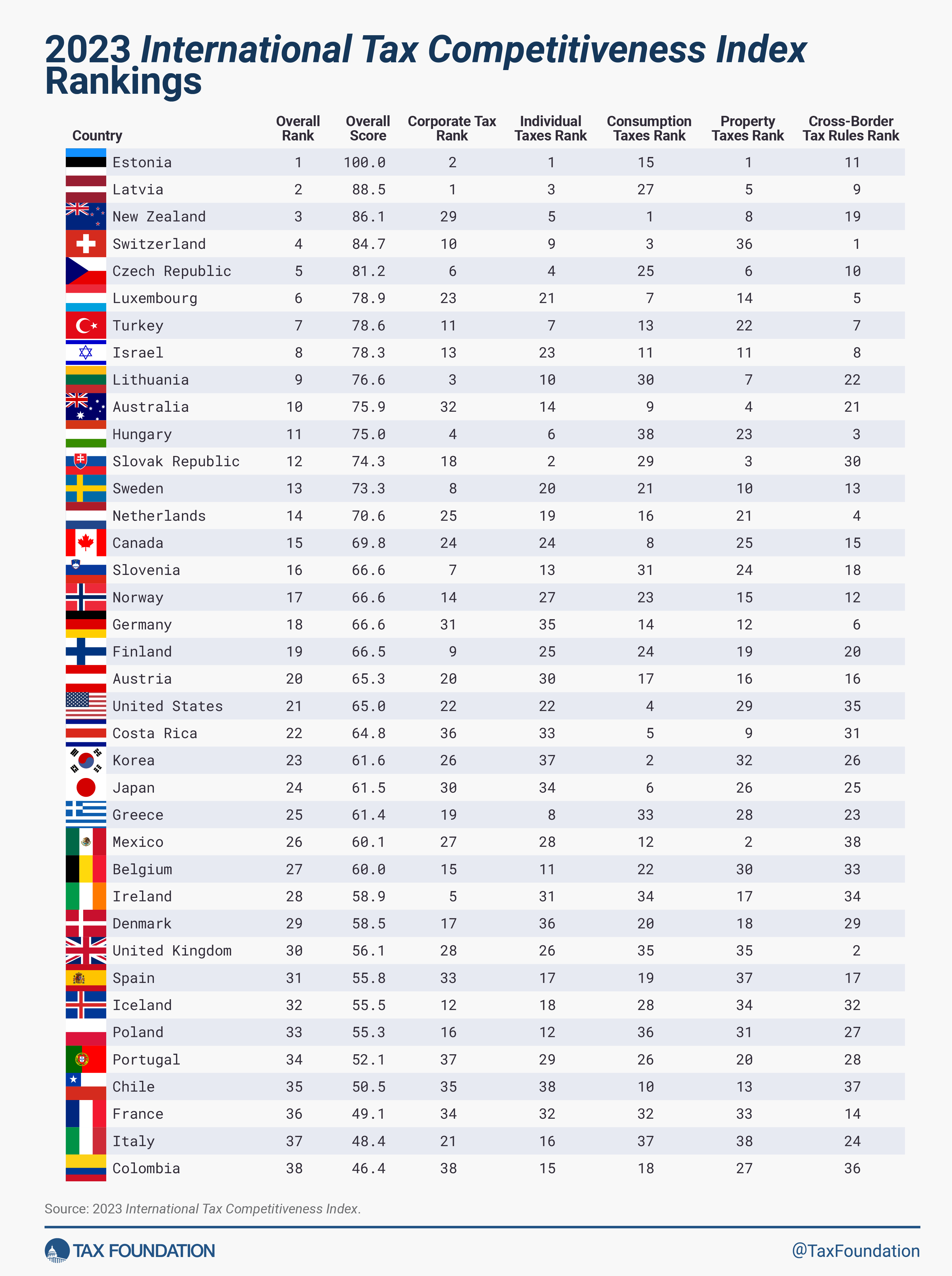

The International Tax Competitiveness Index 2023, compiled by the OECD's Tax Foundation, has seen Estonia top the league for the tenth year in a row making it an ideal destination for those looking to live, work and set up businesses overseas, as well as digital nomads.

The Organisation for Economic Co-operation and Development's (OECD's) International Tax Competitiveness Index (ITCI) seeks to measure the extent to which a country’s tax system adheres to two important aspects of tax policy: competitiveness and neutrality.

It argues that the structure of a country’s tax code is a determining factor of its economic performance. "A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities."

While the UK languishes in thirtieth place (out of 38) down from 27 in 2022, Estonia topped the league table driven by four positive features of its tax system, according to the Tax Foundation.

- It has a 20% tax rate on Corporate income that is only applied to distributed profits, compared to the new UK main rate of 25%.

- It has a flat 20% tax on individual income that does not apply to personal Dividend income, unlike the UK where of course dividends are taxable at increasing rates.

- Unlike our Capital Gains Tax, its property tax applies only to the value of land, rather than to the value of real property or capital.

- It has a territorial tax system that exempts 100% of foreign profits earned by domestic corporations from domestic tax, with few restrictions.

Estonia also has an extensive tax treaty network with limited Withholding tax due where payments are to residents of its treaty partners.

The low rates of tax are made more attractive for those looking to move abroad and especially for Digital nomads looking to spend time in Estonia as, should they stay for less than 183 consecutive days, there is no need to pay taxes. If they stay for more than 183 consecutive days, they pay Income Tax but this is at lower rates than in UK for many individuals.

Latvia follows close behind Estonia, primarily because it adopted its neighbour's system of corporate taxation.

For those seeking warmer climes, the Tax Foundation says New Zealand offers a relatively flat, low-rate individual income tax that also largely exempts capital gains, with a broad-based VAT system, and levies no taxes on inheritance, property transfers, assets or financial transactions.

The UK, on the other hand, only ranked highly for its Cross-border tax rules, coming second. For other tax categories, the UK fared poorly.

It dropped to thirty-fifth place for both consumption taxes (VAT) and property taxes, for example, Stamp Duty Land Tax, Annual Tax on Enveloped Dwellings and Capital Gains Tax.

The Tax Foundation highlighted the UK's recent phasing out its 130% Super-deduction for plant and equipment into full expensing. The increase in the main corporate tax rate from 19% in 2022 to 25% in 2023, while keeping a 19% reduced rate for small and medium-sized companies contributed to the fall in the UK's rating.

Useful guides on this topic

Income, claims & reliefs

This section contains guides to income tax, losses, reliefs, savings and investment income, SEIS & EIS, and much more to assist in tax planning and completing returns under self-assessment.

Dividend tax

This practical tax guide explains how dividends are taxed on or after 6 April 2016. It includes HMRC's own examples, more detailed examples, including an Owner Managed Business (OMB) section together with tax planning tips.

Tax Data Card 2023-24

A summary of key tax rates and allowances for 2023-24 and 2022-23.

VAT

Practical Tax Guides to VAT for the SME adviser and owner.

VtaxP Tax Workouts 2023: Tax Update for OMBs & Taxing the Digital Nomad

External links

OECD Tax Foundation PDF report dowload: International Tax Competitiveness Index 2023

Thousands of accountants and advisers and their clients use www.rossmartin.co.uk as their primary TAX resource.

Register with us now to receive our receive our FREE SME Topical Tax Update & newletter.